Westchester County Appraisal District

Property Tax Rates

Property Tax Rates Below are property tax rates since 2002. If you need earlier rates, e-mail our office at 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000-2001 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000-2001...

https://www.westchestergov.com/property-tax-rates

Westchester County... - Westchester County Government Facebook

“Here in Westchester County, we are creating real opportunity and driving lasting growth because we have a Governor who understands local communities and delivers for them. Progress depends on leadership at the top, and Governor Kathy Hochul is that leader. Since taking office, she has invested in critical local health care institutions, strengthened public safety through investments in law enforcement, gun violence prevention, and community-b...

https://www.facebook.com/westchestergov/posts/westchester-county-executive-ken-jenkins-statement-on-2026-state-of-the-stateher/1336529381850744/

Tax Commission

Below are property tax rates since 2002. If you need earlier rates, e-mail our office at 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000-2001 Below are property tax rates since 2002.

https://www.westchestergov.com/?view=category&id=210&start=10

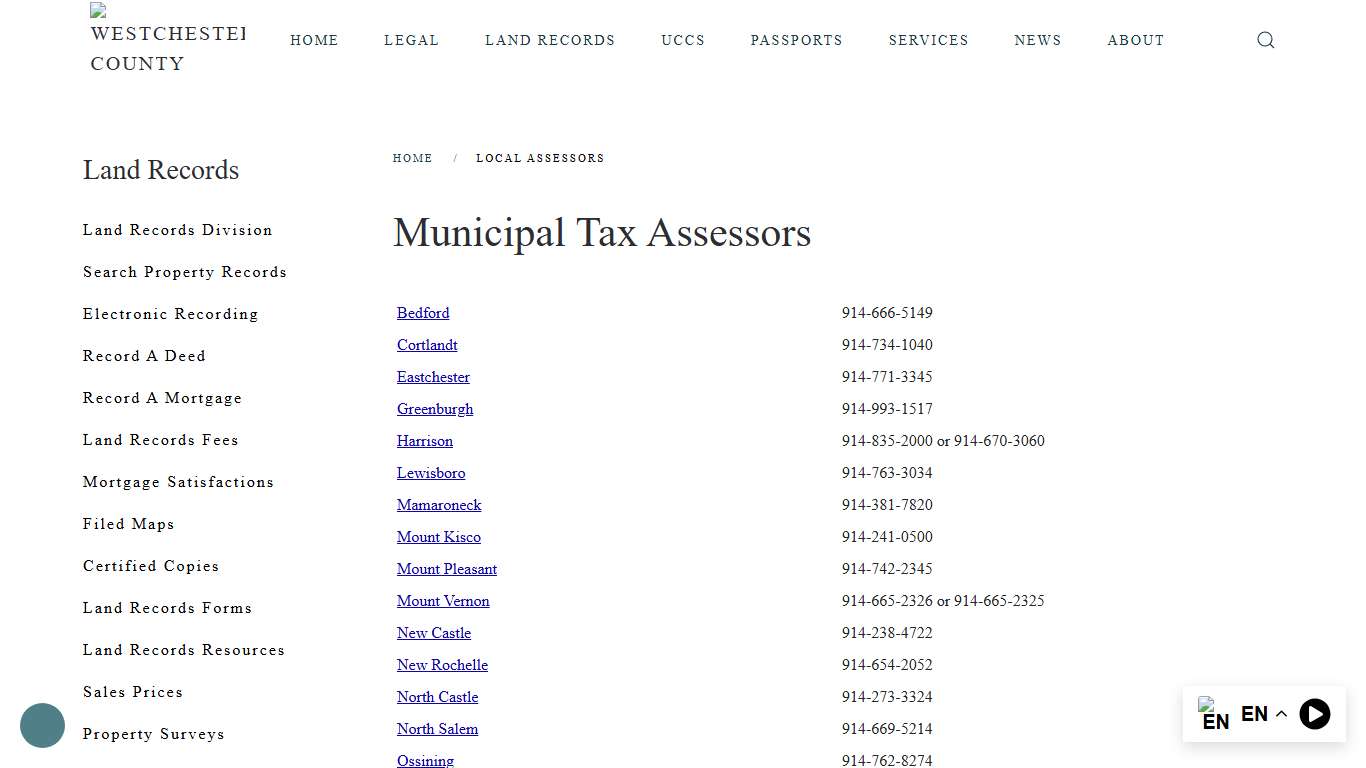

Municipal Tax Assessors

Contact information for the local Municipal Tax Assessors in the Cities, Towns and Villages of Westchester County.

https://www.westchesterclerk.com/local-assessors

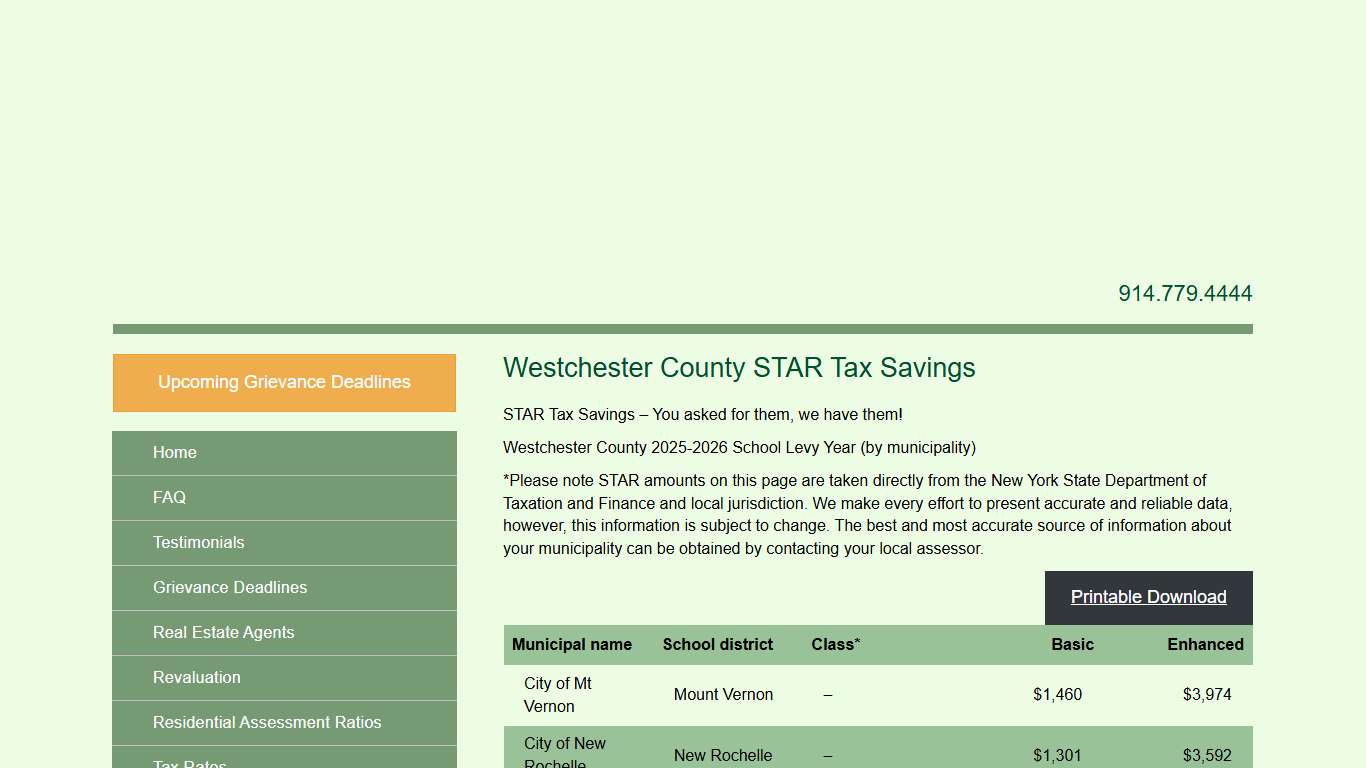

Westchester County STAR Tax Savings - O'Donnell & Cullen Property Tax Consultants

STAR Tax Savings – You asked for them, we have them! Westchester County 2025-2026 School Levy Year (by municipality) *Please note STAR amounts on this page are taken directly from the New York State Department of Taxation and Finance and local jurisdiction.

https://retiredassessor.com/star-savings/westchester-county-star-tax-savings/

2026–2027 Virtual State Budget Forum for Westchester Village of Mamaroneck NY

Notice of Virtual Public Forum 2026–2027 Virtual State Budget Forum for Westchester Friday, January 30, 2026 | 11:00 AM to 3:00 PM | Via Zoom The New York State Assembly Westchester Delegation will host a virtual public budget forum for local organizations, elected officials, residents, and communities of Westchester County to share their views on the Governor’s SFY 2026–2027 Executive Budget.

https://www.villageofmamaroneckny.gov/home/news/2026%E2%80%932027-virtual-state-budget-forum-westchester

Bot Verification

Verifying that you are not a robot...

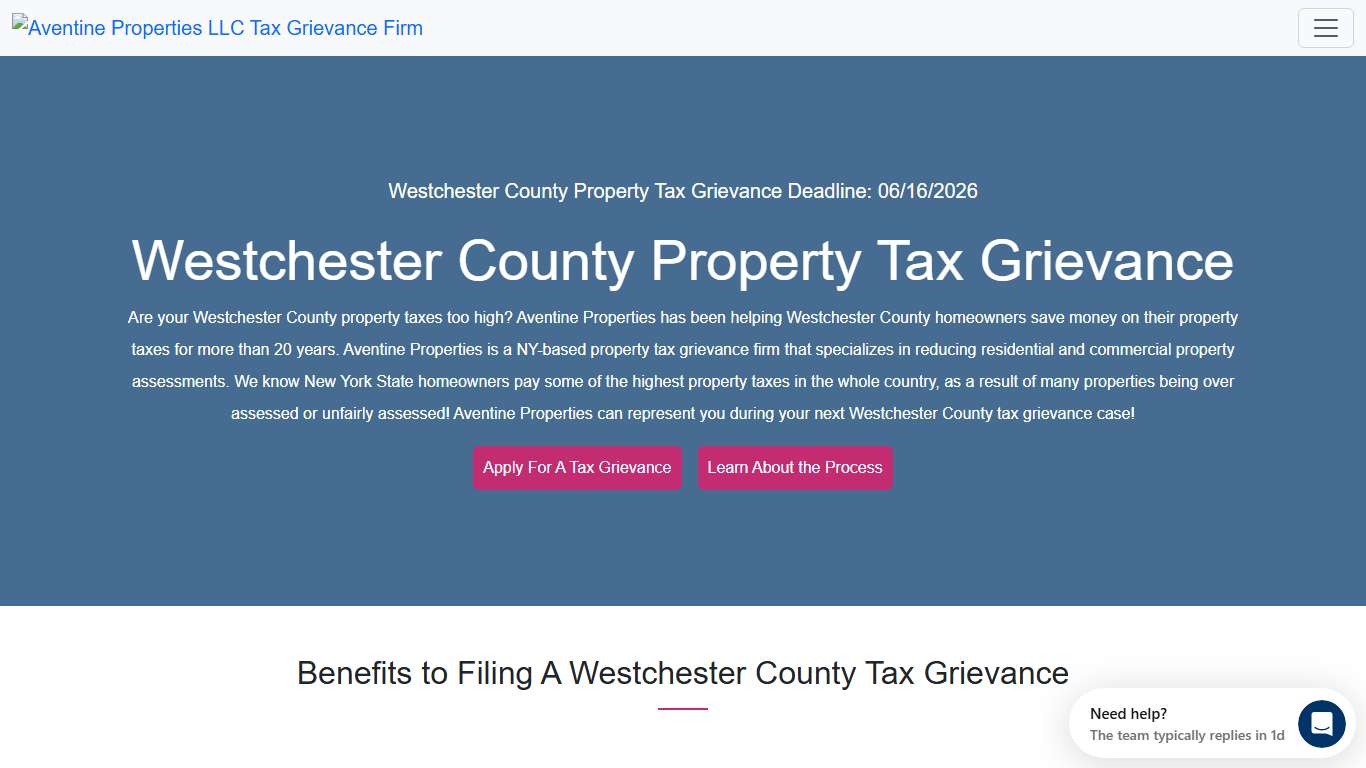

https://crushmytax.com/wp-content/uploads/2025/06/Westchester-Tax-Application-2026-1.pdfWestchester County Property Tax Grievance Aventine Properties

Permanent Tax Savings Ongoing property tax reduction benefit year after year until a town wide reassessment happens. No Upfront Fees You only pay if we obtain a reduction on your assessment. File with us with no payment required! No Downside or Risk Your property assessment can only be reduced.

https://www.aventineproperties.com/westchester-county-tax-grievance/

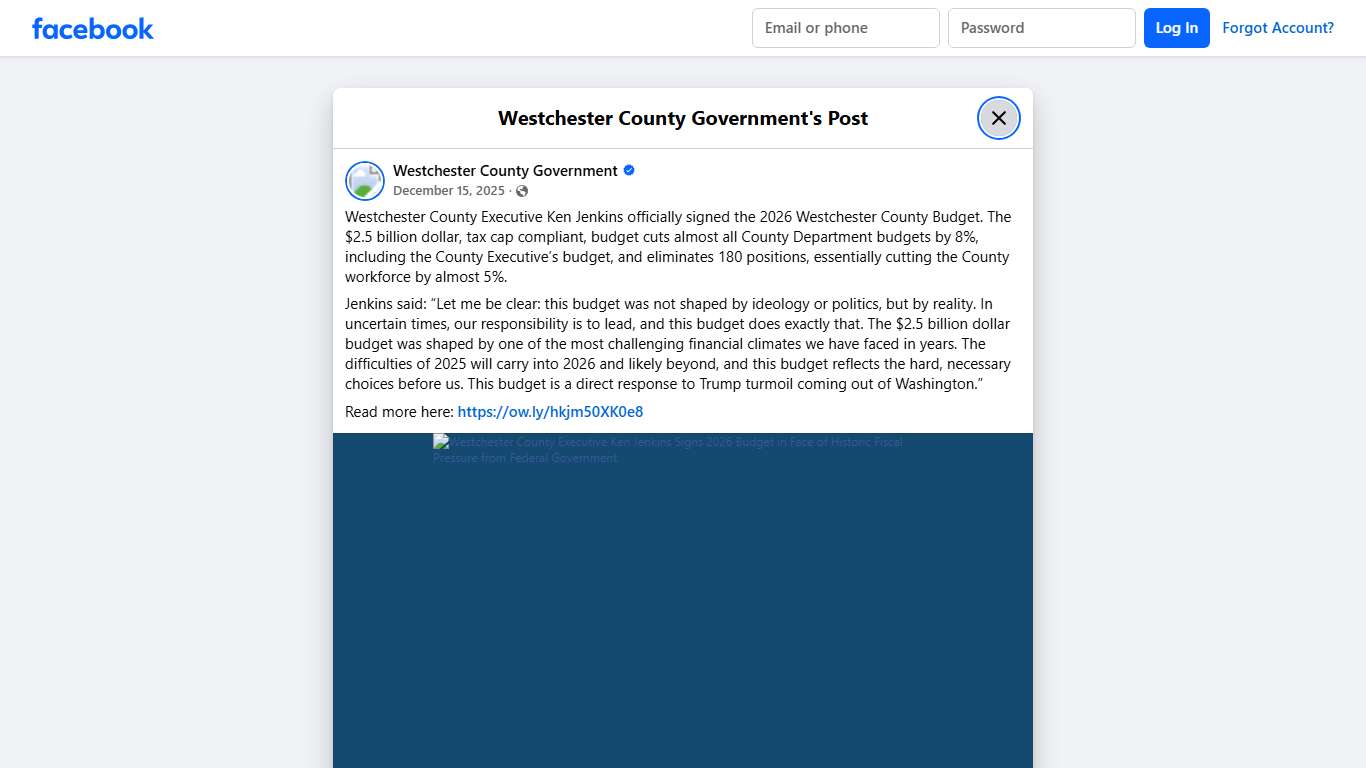

Westchester County... - Westchester County Government Facebook

I saw him speaking on the budget last week. He was brilliant, concise, and had all the numbers at his fingertips. Cuts were painful, but in a no-win scenario necessitated by lower sales tax revenue, skyrocketing health costs and federal cuts, all a result of HR1, I believe the county government did their best.

https://www.facebook.com/westchestergov/posts/westchester-county-executive-ken-jenkins-officially-signed-the-2026-westchester-/1313690004134682/

Assessor Mount Pleasant, NY

Assessor The Assessor is the official who estimates the value of real property, which is converted into an assessment (one component in the calculation of real property taxes). It is the assessor's obligation to maintain a fair and equitable assessment roll.

https://www.mtpleasantny.gov/157/Assessor

Real Property Tax Yonkers, NY

Real Property Tax The City of Yonkers is pleased to announce the arrival of the new Yonkers Online Property Tax Information portal. This link is available to research any City of Yonkers parcel for free. If you have received a Delinquent tax letter, please visit the online portal to review your parcel for details.

https://www.yonkersny.gov/258/Real-Property-Tax

Westchester County... - Westchester County Government Facebook

I saw him speaking on the budget last week. He was brilliant, concise, and had all the numbers at his fingertips. Cuts were painful, but in a no-win scenario necessitated by lower sales tax revenue, skyrocketing health costs and federal cuts, all a result of HR1, I believe the county government did their best.

https://www.facebook.com/westchestergov/posts/westchester-county-executive-ken-jenkins-officially-signed-the-2026-westchester-/1313690004134682/

Tax Department Greenburgh, NY

Tax Department Welcome to the Greenburgh Tax Office Website This office collects annually, over a quarter billion dollars for the County, Town, Fire districts and 10 School districts located in Greenburgh. It is the largest municipal collection agency in Westchester. School Taxes - Part #2 are due January 31st, 2026.

https://www.greenburghny.com/190/Tax-Department

Property Sales Prices

Property Sales Prices We do not keep a listing of the amounts paid for properties. However, that information can often be determined by reviewing the deed for a property. If you come into our office, our staff can help you locate an image of a deed or you can search our records online.

https://www.westchesterclerk.com/land-records/sales-prices

2025 final STAR credit and exemption savings amounts: Westchester County

2025 final STAR credit and exemption savings amounts: Westchester County The table below displays the final STAR credits and STAR exemption savings that homeowners received in 2025. The amounts vary by municipality and school district. To find the amounts in your jurisdiction: - locate your municipality in the left column, and - identify your school district in the next column Note: The amount of your 2025 STAR credit or STAR...

https://www.tax.ny.gov/pit/property/star/comparison/55-westchester.htm

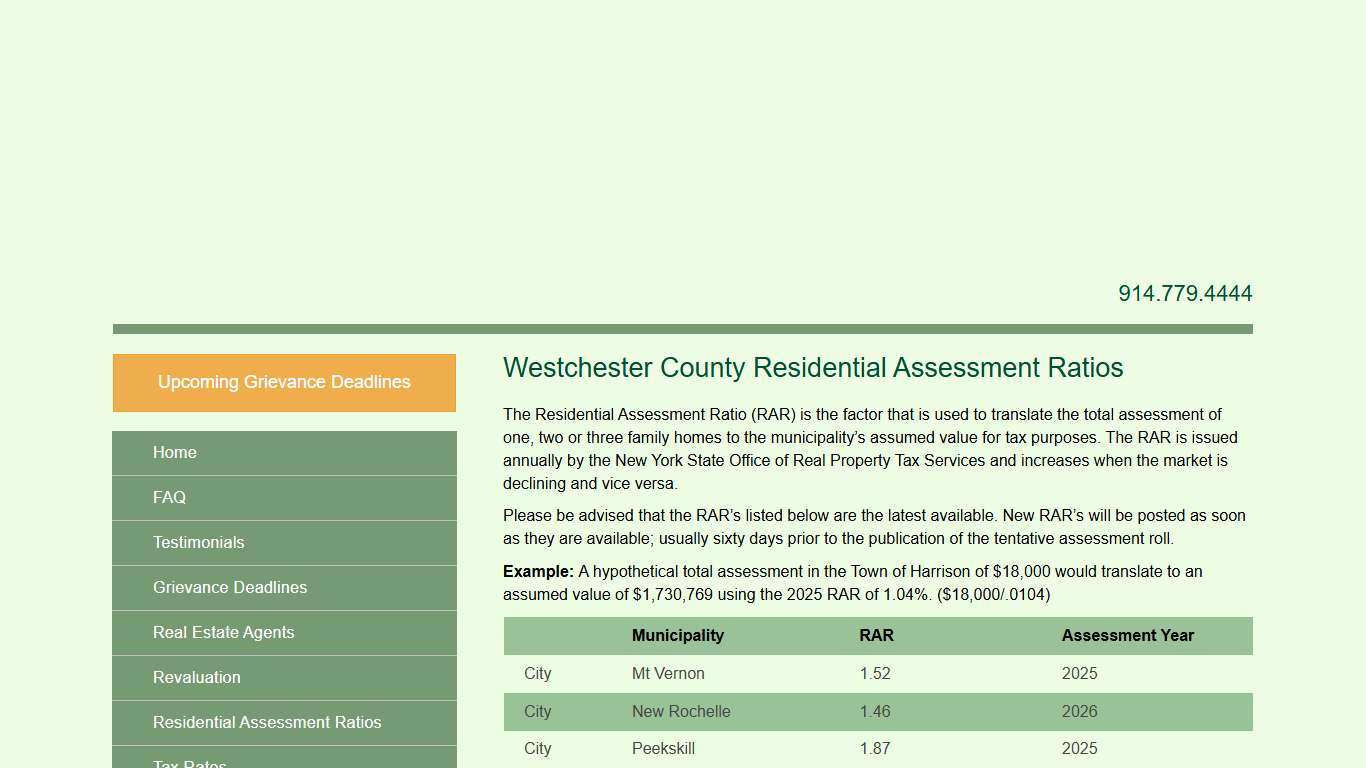

Westchester County Residential Assessment Ratios - O'Donnell & Cullen Property Tax Consultants

The Residential Assessment Ratio (RAR) is the factor that is used to translate the total assessment of one, two or three family homes to the municipality’s assumed value for tax purposes. The RAR is issued annually by the New York State Office of Real Property Tax Services and increases when the market is declining and vice versa.

https://retiredassessor.com/residential-assessment-ratios/westchester-county-residential-assessment-ratios/